Digital Currency Group (DCG) was founded by Barry Silbert and is the parent company of Genesis Global Capital (Genesis) and Grayscale Investments, LLC (Grayscale). After both 3AC and FTX filed for bankruptcy, DCG has been at the centre of the storm because of its huge exposure to both companies. According to Bloomberg's report, Genesis is actively seeking fresh funds and is potentially facing bankruptcy if there's no new funding.

If you want to know the background or history of DCG, you have review Deep Dive's analysis : https://thedeepdive.ca/the-digital-currency-group-debacle-explained/.

Basic Structure of Digital Currency Group from the Deep Dive

At first, I want to do some due diligence because I am discussing with my friends whether Grayscale will collapse or not. With the on-chain data forensics, I believe that Grayscale has enough bitcoin reserves. However, the liability of DCG and Genesis is way more complicated than we had expected, and since they are exposed to 3AC and FTX, the situation is pretty bad. Other than FTX (and Alameda), Coinbase, Circle, Bitfinex, and Binance have also done transactions with Genesis; do they all have exposure to Genesis?

In my opinion, FTX and DCG could be the two centres of the storms, and if two of them meet up with each other, the destructive effects could be amplified. Anyways, I'd like to share some data and analysis on what's happening to the DCG group.

The OXT Research analyst, Ergo, used on-chain forensics to confirm that as of Nov 23 that the GBTC owns approximately 633k Bitcoin BTC tickers down $16,194 held by its custodian, Coinbase Custody.

GBTC Discount/Premium to NAV from

YChart

On November 28,

the market cap of GBTC was $1.58 billion. However, GBTC currently has a -40.23% discount to NAV. According to the website, the discount or premium to NAV is a percentage that calculates the amount that an ETF or closed-end fund is trading above or below its net asset value (NAV). If there is a -40.23% discount, that means GBTC is facing a 40.23% discount when compared to the market value of bitcoin. Although there is a huge gap between GBTC and Bitcoin, there is no way to redeem GBTC for Bitcoin at this moment.

Grayscale has been using Coinbase Custody, and we can optimistically assume that Coinbase strictly follows the regulation and has a reliable audit firm because they are a US-listed company. Although Grayscale has enough BTC, it does not mean that Genesis's great loss can be covered. If Genesis has no fresh funds, it may go bankrupt.

Genesis

Genesis is a New-Jersey-based lending desk which offers crypto lending services. Genesis Global Capital, LLC (“GGC”) is also registered as a Money Services Business with FinCEN, that means Genesis is under the United States' regulatory framework.

Genesis's MSB information from https://www.fincen.gov/msb-registrant-search

According to a Bloomberg report, Genesis has an outstanding loan of $2.8 billion on its balance sheet, and around 30% ($0.84 billion) of its lending has been made to related parties, including its parent company. Digital Currency Group DCG's founder and CEO, Barry Silbert, claimed that DCG has a liability to Genesis of around $575 million, due in May 2023, and that the loans were used to "fund investment opportunities and to repurchase DGC stock from non-employee shareholders in secondary transactions previously highlighted in quarterly shareholder updates." The report further described a promissory note owed by Genesis to DCG worth $1.1 billion, which will come due in June 2032.

Genesis has a great deal of exposure to Three Arrow Capital (3AC), encountering potential losses in the hundreds of millions, as CoinDesk reported. Since 3AC filed for bankruptcy after Terra's rug pull, Genesis could face a total loss. According to another Coindesk report, 3AC provided $1.2 billion in collateral. In detail, 3AC has borrowed a total of 2.36 billion dollars, and the loans were partly collateralized with 17.4 million shares of the Grayscale Bitcoin Trust (GBTC), 446,928 shares in the Grayscale Ethereum Trust (ETHE), 2.7 million AVAX tokens, and 13.9 million NEAR tokens, all of which have been liquidated by Genesis.

Genesis exposure to FTX

As you may know, Genesis officially announced that they have $175 million worth of cryptoassets locked in FTX. According to Cryptoslate's research, Genesis also received over $1 billion worth of FTT from Alameda and FTX (source: Arkham Intelligence).

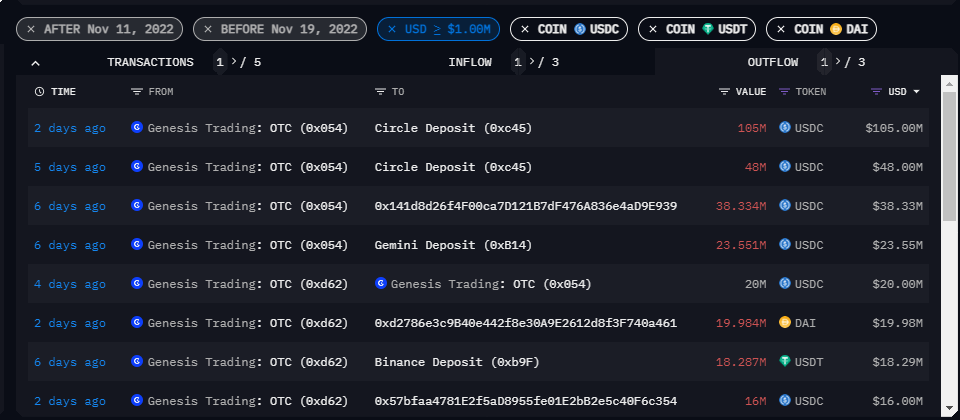

After FTX's collapse, Genesis soon halted clients' withdrawals. Using Arkham Intelligence's dashboard for on-chain analysis, CryptoSlate discovered that Genesis redistributed 250.9 million USDC, 18.3 million USDT, and 20 million DAI. The Genesis OTC has around $290 million in stablecoin redemptions from November 11, 2022, to November 19, 2022.

Genesis' Exchange Usage

From 7/24/2019 to 10/23/2022, we can see from the exchange usage that the top 10 counterparties are Circle, Coinbase FTX, Gemini, Bitfinex, Binance and Alameda Research (Source: Arkham Intelligence).

The data reveals:

-Circle deposited $6.12 billion and withdrew $4.64 billion (-1.48 billion);

-Coinbase deposited $6.09 billion and withdrew $4.98 billion (-1.11 billion);

-Genesis deposited 3.95 billion and withdrew 1.38 billion (-2.57 billion);

-FTX deposited $4.92 billion and withdrew $6.87 billion; Alameda Research deposited $2.7 billion and withdrew $129,73 million (FTX and Alameda -$620,270 million).

-Bitfinex deposited $1.35 billion and withdrew $1.27 billion ( -80million).)

-Binance deposited $1 billion and withdrew $279.52 million (-720.48 million);

Please note that Genesis is a crypto lending platform, and the institutions can use collateral to borrow more cryptoassets. However, the institutions may also use the Genesis OTC service. Either the counter-parties use Genesis' crypto lending service or OTC service; if the institution's deposited fund is less than its withdrawal fund, the following are possible explanations:

1. Institutional funds are kept in Genesis. Since Genesis has halted withdrawal, it could be an exposure.

2. The funds are withdrawn to other wallet addresses that have not been labeled.

3. There are some transactions that were not recorded between 7/24/2019 and 10/23/2022 and therefore will not be revealed on the above dashboard.

4. If the institutions use Genesis' OTC service, they can sell cryptoassets for fiat money. (In this way, Institution X had to deposit crypto into Genesis, and Genesis transferred fiat money to X via wire transfer, EFT, etc.) Of course, institutions may also buy crypto with fiat. (In this way, Institution X had to send fiat money to Genesis' bank account and withdraw crypto from Genesis.) If institution X's crypto-assets' total selling amount is larger than its total buying amount, then deposit amount > withdrawal amount. If we don't consider institution X, it may use other Genesis' services.

5.Some clients use insitutions' wallet address for sending and receiving crypto-assets when they trade with Genesis OTC.

FYI, I will attach the Genesis' OTC wallet's exchange usage (source: Arkham Intelligence). BlockFi, which has filed Section 11 Bankruptcy protection on Nov 28, 2022, also traded with Genesis OTC.

However, if the institutions have deposited funds or collateral into Genesis and have not withdrawn them all, they have pretty huge exposure to Genesis.

The Genesis Trading's Portfolio in Arkham Intelligence

Let's gather the information.

1. Genesis had received over $1 billion worth of FTT from Alameda and FTX.

2.Other institutions that have done business with Genesis may have funds in the platform that are not completely withdrawn, totaling at least $1 billion.

3. As seen from the above chart, Genesis Trading only has a total of crypto-assets worth US $229.97 million.

4. On November 17, the

WSJ published that crypto lender Genesis had sought an emergency loan of $1 billion.

The number matches what Genesis had said: If they cannot acquire a $1 billion emergency loan from others, they may have to file bankruptcy. The Domino effect is tremendous because Genesis is linked to different crypto institutions. Would the DCG group blast the next crypto bubble? Let's see.

Comments

Post a Comment